Quantum computers likely to reveal if Satoshi is alive — Adam Back

Early cypherpunk Adam Back, cited by Satoshi Nakamoto in the Bitcoin white paper, suggested that quantum computing pressure may reveal whether the blockchain’s pseudonymous creator is alive.During an interview after a Q&A session at the “Satoshi Spritz” event in Turin on April 18, Back suggested that quantum computing may force Nakamoto to move their Bitcoin (BTC). That’s because, according to Back, Bitcoin holders will be forced to move their assets to newer, quantum-resistant signature-based addresses.Back said that current quantum computers do not pose a credible threat to Bitcoin’s cryptography but will likely threaten it in the future. Back estimated that quantum computers may evolve to that extent in “maybe 20 years.”Related: Bitcoin’s quantum-resistant hard fork is inevitable — It’s the only chance to fix node incentivesWhen the threat becomes real, Back said the Bitcoin community will have to choose between deprecating old, vulnerable addresses or letting those funds be stolen:“If the quantum computers are here, and people at universities and research labs have access, the network has a choice to either let people steal them or to freeze them — to deprecate the signature.“Back expects the community to go with the former option, forcing Bitcoin’s pseudonymous creator to move their funds if they wish to avoid losing them.Privacy upgrades could complicate proofStill, Back said that whether such a situation will reveal if Satoshi Nakamoto is alive also depends on Bitcoin’s future privacy features.“It depends a bit on the technology, there are some research ideas that could add privacy to Bitcoin,” Back said. “So, possibly there might be a way to fix quantum issues while keeping privacy.“Related: Lawyer sues US Homeland Dept to probe supposed Satoshi Nakamoto meetingStill, not everyone is convinced that — privacy enhancements or not — such a scenario would reveal whether Nakamoto was alive. An anonymous early Bitcoin miner and member of the Bitcoin community told Cointelegraph that he does not expect Nakamoto’s coins to be moved:“Even if he is alive and holds the private keys, I do not think he’d move them. Based on how he acted so far I would rather expect him to let the community to decide.”He added that, since this is a controversial choice, it makes sense to let the community decide. He said that he’d be surprised if Nakamoto came out of the woodwork to move the assets.A quantum-resistant BitcoinBack explained that most quantum-resistant signature implementations are either unproven in terms of security or very expensive from a data perspective. He cited Lamport signatures as an old and proven design, but pointed out that they weigh tens of kilobytes.Consequently, he suggested that Bitcoin should be prepared to switch to quantum-resistant signatures but only do so when necessary. He suggested a Bitcoin taproot-based implementation allowing addresses to switch to quantum-resistant signatures when needed.Magazine: Bitcoin vs. the quantum computer threat: Timeline and solutions (2025–2035)

Buying Bitcoin vs gold: Which is easier for investors to purchase?

As gold prices break new highs, many Bitcoiners are seeking ways to obtain exposure to the precious metal, but have been met with hurdles along the way.Although physical gold is accessible in the form of jewelry, gold bars and coins, many industry executives are concerned about aspects like its quality, liquidity when selling, and buying at a premium above spot prices.Still, gold advocates are confident that the precious metal is much easier to buy than Bitcoin (BTC), given the complexities of storing private keys and a steep learning curve for new crypto investors.Both Bitcoin and gold are available in the form of tokenized assets, exchange-traded funds (ETFs) and other equity instruments, but the question of owning these assets in their original form reveals some differences.Community: Buying Bitcoin is easier and faster“Buying Bitcoin is significantly easier and faster than buying physical gold,” Ross Shemeliak, co-founder of the tokenization platform Stobox, told Cointelegraph.He referred to Bitcoin’s instant and 24/7 availability and no need for vaults, while gold is associated with additional costs like transportation, storage, verification and resale.Adam Lowe, chief of product at the self-custody firm CompoSecure, agreed that buying physical gold is subject to many challenges and additional costs.“The first is maintaining quality, assuring the purity is accurate,” Lowe said, adding that investors have to rely on the reputation of dealers and the supply chain when buying physical gold.Related: Bitcoin may rival gold as inflation hedge over next decade — Adam Back“Selling liquidity is also an issue as you have to find a buyer and will most likely pay a discount relative to the market price per ounce,” he continued, adding that self-custodied Bitcoin has none of these issues.As well as limited liquidity, retail investors in physical gold face widened spreads, Shemeliak said, as they often have to buy at a premium above the market price of gold.Gold advocate: Bitcoin self-custody is not easyUnlike crypto investors, traditional finance (TradFi) investors and analysts are not so excited about self-custody opportunities offered by Bitcoin.“Bitcoin could be very easy to buy if you have everything set up already, but if you don’t, it’s very difficult,” Rafi Farber, publisher of the gold-focused marketplace service End Game Investor, told Cointelegraph.Farber, who has emerged as one of the biggest Bitcoin critics, referred to investor challenges for Bitcoin self-custody, which requires holders to safely store their private key or risk losing access to the coins.While dealing with a self-custodial wallet, users have to “remember a string of random words or copy it down and put it in a safe, then copy and paste a gibberish code,” Farber said. “And if you lose any of the codes or the power goes out for whatever reason you’re screwed.”Self-custody wallet providers offer onboarding sessions for $99 per hour. Source: TrezorFarber’s concerns over the challenges of self-custody are not without merit. Trezor, one of the most prominent self-custody wallet providers, admits that usability remains one of the key issues faced by self-custodial wallets.While some have tried to offer simplified self-custody options, others insist that holding a private key is the only way to actually own a cryptocurrency, which requires onboarding and a learning curve — but doesn’t come without its own costs.Is Bitcoin a direct competitor to gold?On the other hand, physical gold is “very easy to buy,” Farber said, suggesting options like coins or jewelry shops.“Yes, buying a gold coin at a jewelry or coin shop is easy — but that doesn’t mean you’ve made a sound investment,” Stobox’s Shemeliak countered:“Without verified origin, proper assay, secure storage, and a liquid resale market, you’ve likely bought a souvenir, not a serious store of value.”“In contrast, digital assets like Bitcoin or tokenized gold offer transparency, liquidity and verifiability,” he added.Shemeliak doesn’t see Bitcoin and gold as direct competitors.“Gold will always have historical value, but Bitcoin is building financial infrastructure for the next 100 years,” he said.At the time of publication, the price of spot gold stood at $3,327, up nearly 27% year-to-date (YTD) as it continues breaking new highs, according to TradingView.The picture is less appealing for Bitcoin, which reached new highs around $110,000 in December 2024. Bitcoin is down 10% YTD, trading at $84,525 at publication, according to CoinGecko.Magazine: Financial nihilism in crypto is over — It’s time to dream big again

Astar reduces base staking rewards to curb inflation pressure

Blockchain firm Astar Network implemented changes to its tokenomics to reduce inflationary pressures in its ecosystem. On April 18, Astar Network announced that it reduced the blockchain’s base staking rewards to 10% from 25% to curb token inflation. The company said the change promotes a more stable annual percentage rate (APR) for users as staking inches closer to a more ideal ratio. The firm said this ensures that rewards “remain meaningful” without causing excessive inflation. “This change lowers automatic token issuance, reducing overall inflationary pressure while maintaining strong incentives for users to stake their ASTR,” Astar Network wrote. Astar Network highlights key changes to its tokenomics. Source: Astar NetworkAstar Network implements inflation-control mechanismsUnlike Bitcoin, which has a fixed total supply, the ASTR token operates under a dynamic inflation model without a cap on its maximum token supply. As the blockchain operates, it emits more tokens, increasing the supply. Having no fixed supply can often create downward pressure on the token’s value over time. This is especially true if the demand for the token does not keep up. To address this, Astar is introducing several new inflation-control mechanisms.Apart from lowering staking rewards, Astar also started routing token emissions into a parameter that governs total value locked (TVL)-based rewards like decentralized application staking. This means that DApp staking APRs will become “more predictable” over time, offering stability to stakers. Astar also introduced a new minimum token emission threshold of 2.5% to ensure it doesn’t exceed a sustainable baseline. With continued transaction fee burning, Astar said it would also contribute to reward predictability. According to Astar, the changes have already lowered its annual inflation rate from 4.86% to 4.32%. It also lowered its total ASTR token emitted per block from 153.95 to 136.67 tokens. This reduces the token’s estimated annual emissions by 11%, going from 405 million to 360 million. Related: Sony’s Soneium taps EigenLayer to cut finality to under 10 secondsAstar token hits all-time low on April 7Astar Network’s efforts to curb token inflation come as its native token recently hit an all-time low. CoinGecko data shows that on April 7, the ASTR token declined to a new low of $0.02. The price is 93.8% lower than its peak three years ago, when it reached $0.42 on Jan. 17, 2022. In December 2024, the token rallied along with the rest of the market, hitting a high of $0.09. Since then, the crypto asset had continuously dropped in value before hitting the new all-time low. Astar Network’s 1-year price chart. Source: CoinGeckoMagazine: Uni students crypto ‘grooming’ scandal, 67K scammed by fake women: Asia Express

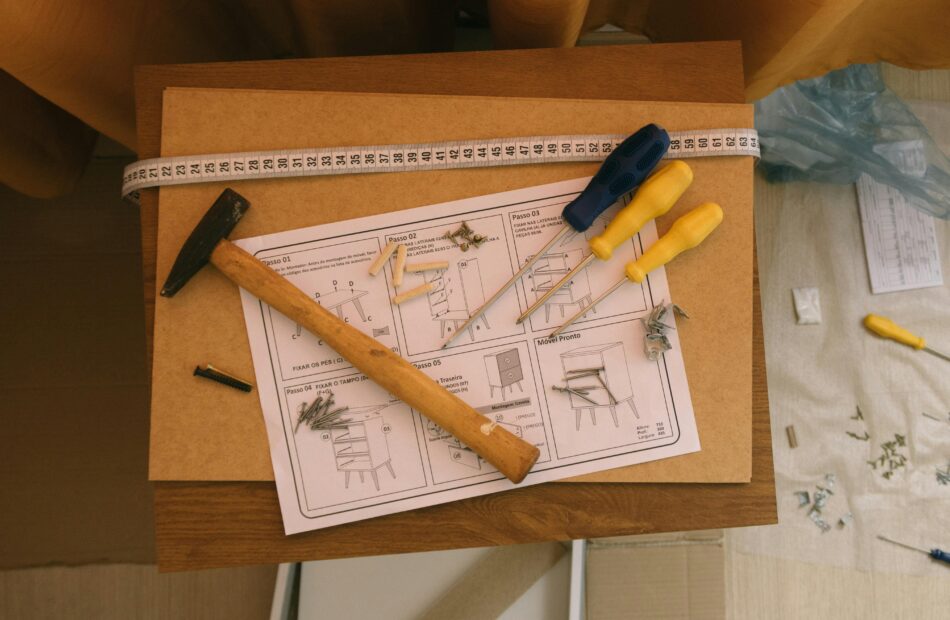

How to use a crypto hardware wallet: A step-by-step guide

TL;DRThis guide shows you how to set up and use a crypto hardware wallet, using the Trezor Safe 3 as an example. You’ll learn to safely store Bitcoin, Ethereum and other assets offline, with clear steps for wallet setup, seed phrase backup, PIN protection and secure transaction signing. The article also explains how to connect your hardware wallet to MetaMask for use with DeFi platforms and NFTs – all while keeping your private keys offline. Whether you’re comparing the best hardware wallets in 2025 or need a crypto wallet tutorial for receiving and sending funds, this guide has you covered with actionable tips and best practices for long-term cold storage security.If you’re ready to take crypto wallet security seriously, using a hardware wallet is one of the best steps you can take. You may already be aware of its advantages over a software wallet: keeping your private keys offline, minimizing exposure to malware and giving you full ownership of your crypto assets. Maybe you’ve even picked out your device.The good news? While there are several options out there, from Ledger to Trezor to newer multichain hardware wallets, the basic experience is similar. This hardware wallet setup guide will walk you through unboxing, verifying the device, securing your PIN and backing up your seed phrase.For illustration purposes, this article uses the Trezor Safe 3, an ideal device for beginners but powerful enough for advanced users. It’s also a great choice if you want to use a hardware wallet for DeFi or connect your hardware wallet to MetaMask.Let’s get into it.Unboxing your crypto cold walletBefore you begin setup, here’s what comes with a typical hardware wallet, in this case, the Trezor Safe 3. This applies to most of the best hardware wallets in 2025.What’s in the box:Trezor Safe 3 device with tamper-evident seal.USB-C cable.Two recovery seed cards (for your wallet backup).Quick start guide.Trezor stickers.First steps: Inspect and verifyBefore plugging anything in, check for:Sealed, undamaged packaging.Intact holographic sticker over the USB port.This ensures your device hasn’t been tampered with, a crucial crypto wallet security tip. Newer devices (post-April 2024) have upgraded seals for added air-gapped security.If anything looks suspicious, contact Trezor support.Power it upPeel the sticker and connect via USB — the Safe 3 powers on automatically, and no battery or power button is needed.You’ll notice a small screen and two physical buttons. These are how you’ll confirm actions, approve transactions and manage your crypto.Let’s begin the setup.Hardware wallet setup: Trezor Safe 3Getting started takes about 10–15 minutes. For this crypto hardware wallet tutorial, just have your computer ready and a pen handy. You’ll soon need to write down something very important.Step 1: Download Trezor SuiteGo to the official Trezor site and download the Trezor Suite app. It’s available on Windows, macOS, Linux and via web browser.Open it, plug in your device and follow the prompts. Click “Set up my Trezor.”Step 2: Install firmwareYour device may not come with firmware pre-installed. Click “Install Firmware.” This is part of the crypto wallet recovery process and ensures a secure, clean slate.Step 3: Verify device authenticityClick “Let’s check your device” in Trezor Suite. Press the right button on your Safe 3 to authenticate. You’ll see a message confirming the device is verified.Step 4: Quick tutorialThe device might walk you through button usage. Just follow along, it’s a one-time setup.Step 5: Create a new walletYou’ll see two options:Create new wallet (choose this if it’s your first time).Recover wallet (for restoring, using your seed phrase).Step 6: Backup methodYou’ll choose between:Standard seed backup (easiest and most common).Shamir backup (advanced; splits the seed into parts).Stick with standard, unless you’re sure you know what you’re doing.Step 7: Confirm on deviceUse the buttons to confirm your backup method and agree to terms. Press “Create wallet” to proceed.Step 8: Write down your recovery seedThis is the heart of your cold storage for crypto. The device will generate a random list of 12, 20 or 24 words, your recovery seed.Trezor will remind you not to take photos or digital notes of the seed. Write it down on the provided card and store your crypto seed phrase safely. This is critical for future recovery.Step 9: Confirm the seedYou’ll be tested on a few of the words (e.g., “What’s word #5?”). Select the correct ones using the buttons. Once confirmed, your backup is complete.Pro tip: Make a second copy of your seed and store it in a different secure location. This adds an extra layer of protection.Step 10: Set up a PINNow, create your hardware wallet PIN. In Trezor Suite, click “Set PIN.” The device will prompt you with a randomized layout. Use the buttons to choose your digits.PINs can be up to 50 digits long. Choose something memorable, but not obvious. If forgotten, you’ll need to wipe the wallet and recover with the seed phrase.Step 11: Enable coins and final setupYou’ll now choose which coins to enable, Bitcoin (BTC), Ether (ETH) and more. This step also prepares your wallet for use with DApps or storing Bitcoin in a hardware wallet.After clicking “Complete Setup,” you can name your device or customize the home screen. Then hit “Access Suite” to open your dashboard.If you’ve been following along on your own device, you’ve just completed your first hardware wallet setup and taken a major step toward storing crypto safely!Receiving crypto with a hardware walletOnce your device is set up, you’re ready to store crypto safely by receiving funds into your wallet. Here’s how to accept crypto securely with your Trezor hardware wallet.1. Open the correct accountIn Trezor Suite, choose the account for the crypto you want to receive (e.g., Bitcoin #1 or Ether #1). Click the “Receive” tab to generate a crypto cold wallet address.2. Show and confirm the addressClick “Show full address” in the app. Your Trezor will display the full address on its screen. Always confirm the address on the hardware wallet itself, not just in your browser. This ensures it hasn’t been altered by malware on your computer (a standard crypto wallet security tip).3. Use the addressCopy the address or scan the QR code to send crypto. Your Trezor doesn’t need to stay connected; the blockchain will receive the funds and update your balance next time you plug the wallet in.Pro tips for safe receiving:Confirm addresses on your device, not just your screen.Use a fresh address each time for added privacy (Trezor Suite supports this).If the address doesn’t match between your wallet and app, stop immediately.Sending crypto from a hardware walletSending crypto with a hardware wallet means your private key stays offline, even while broadcasting a transaction. Here’s how to do it securely:1. Select the correct accountIn the Trezor Suite, go to the account holding the asset you want to send. Click “Send.”2. Fill in transaction detailsEnter the recipient’s wallet address and the amount to send. You can also toggle to fiat view if needed. Double-check the recipient address to avoid mistakes.3. Choose a FeeFor Bitcoin, you can select from fee levels: Low, Standard or High.For Ether or ERC-20 tokens, Trezor Suite estimates gas fees automatically.4. Confirm on the deviceClick “Review & Send.” Your Trezor will display the transaction details:Destination address.Amount.Network fee.Only approve the transaction if everything checks out. This is how you protect yourself from clipboard malware.5. Done, signed transaction is now sent!Your signed transaction has now been sent, with zero exposure of your private key. You’ll see the confirmation in your history.More pro tips:If your Trezor asks to sign a transaction you didn’t initiate, cancel immediately.Make sure your ETH balance is sufficient to cover gas for token transfers.For advanced users: Trezor also supports air-gapped security setups using microSD backups.Using a hardware wallet with MetaMask and DAppsWant to use your hardware wallet for DeFi or NFTs while keeping your keys secure? Trezor Safe 3 integrates seamlessly with MetaMask, making it easy to use DApps and sign transactions safely.1. Connect Trezor to MetaMaskOpen MetaMask in your browser. Click your account icon and choose “Connect Hardware Wallet.” Select Trezor when prompted.2. Plug in your TrezorIf not already connected, plug in the device. MetaMask may prompt you to install Trezor Bridge, a utility that enables communication with the wallet.You’ll be asked to approve the reading of your public key from the hardware wallet. This is safe and doesn’t reveal private keys.3. Select a wallet addressMetaMask will list your Trezor-linked Ethereum addresses. Choose one (e.g., Ethereum #1) and click “Unlock.” The wallet will now appear in MetaMask, marked as a hardware wallet.How it worksFrom now on, every time you make a transaction, whether it’s swapping tokens on Uniswap or minting an NFT, you will:Initiate the transaction in MetaMask.See the details appear on your Trezor screen.Physically confirm the transaction using your device buttons.This flow ensures that even if your browser is compromised, the final transaction approval happens on your trusted hardware wallet.Final safety tip: Your hardware wallet screen is the most trustworthy place to verify transaction details. Never rely solely on what you see in the browser.Why hardware wallets matter in 2025Whether you’re storing Bitcoin, using DeFi protocols or exploring NFTs, hardware wallets remain the gold standard for crypto security. With cold storage for crypto, recovery tools like seed phrases and integration with platforms like MetaMask offer powerful protection with ease of use.If the Trezor Safe 3 feels like a good fit, it’s available at a discount via the provided link, a smart first step into secure, self-custodied crypto.Still weighing your options? Explore the updated 2025 guide to the best hardware wallets. It covers Ledger setup, Trezor guides, and more, including advanced models for multichain use, long-term backups and offline storage.Disclaimer. Cointelegraph does not endorse any content or product on this page. While we have striven to provide all the essential information available in this article, please note that it contains affiliate links. Readers are encouraged to conduct their own research before making any decisions related to the company. This article should not be considered investment advice.

Spar supermarket in Switzerland starts accepting Bitcoin payments

Global grocery giant Spar has rolled out Bitcoin-based payments in a Swiss city, marking another step in the growing adoption of cryptocurrency for everyday transactions.A Spar supermarket in Zug, Switzerland, has implemented Bitcoin (BTC) payments via the Lightning Network.The store’s Bitcoin payments went live on BTC Mao, a community-driven project highlighting stores that accept BTC payments, DFX Swiss, a crypto-to-fiat payment solution firm, announced in an April 17 LinkedIn post.“This SPAR location is among the first supermarkets in Switzerland where you can pay directly at the checkout using Bitcoin (via LNURL), thanks to our new hashtag#OpenCryptoPay solution, an open P2P standard for in-person crypto payments,” DFX said.Spar in Zug adopts Bitcoin payment, announcement. Source: DFX SwissSwitzerland has long been regarded as one of the more crypto-friendly European jurisdictions with some of the earliest crypto-adoption initiatives.In 2023, the Swiss city of Lugano adopted Bitcoin and Tether USDt (USDT) payments for all municipal fees, one of the world’s first city administrations to do so.There are currently 1,013 stores and businesses accepting Bitcoin payments in Switzerland, according to BTCmap data.Businesses accepting Bitcoin payment in Switzerland, Europe. Source: BTCmapRelated: ‘Bitcoin Standard’ author to develop Austrian economics curriculum for UK schoolBitcoin adoption among retail giants with a global presence may increase mainstream trust in cryptocurrency payments.Spar operates over 13,900 stores across 48 countries, with over 14.7 million daily shoppers and 450,000 employees worldwide.Related: Crypto, stocks enter ‘new phase of trade war’ as US-China tensions riseSpar in Zug enables seamless Bitcoin payment via QR codeFriction points and complicated user experience are often criticized as some of the biggest hurdles limiting mainstream blockchain adoption.However, Spar’s Bitcoin implementation enables easy payments by scanning a simple quick-response (QR) code, according to Rahim Taghizadegan, a university lecturer and director of Bitcoin Association Switzerland.In an April 16 LinkedIn post, he outlined how simple it is to pay using BTC in Spar:“Just scan a static QR code, send sats, immediate and easy registration by the cashier. If enough people use it, it may be rolled out in the whole country. ““I used Phoenix Wallet for [the Lightning Network], but pretty much anything works,” he added.Bitcoin payment in Spar, Zug, Switzerland. Source: Rahim TaghizadeganIncreasingly more companies are adopting cryptocurrency in the country. Switzerland-based blockchain ecosystem Crypto Valley surpassed $593 billion in valuation in 2024 after a 55% yearly increase, Cointelegraph reported on Jan. 21.Crypto Valley Unicorns. Source: CvVc.comAmong the 50 regional entities, 17 have reached unicorn status, with a $1 billion or more valuation.“A Swiss industry where the Top 50 entities share a valuation of $593 billion and whose funding medians exceed global medians reflects vision and resilience,” Mathias Ruch, founder and CEO of CV VC, told Cointelegraph.Top 50 projects in Crypto Valley. Source: CvVc.comSome of Crypto Valley’s well-known projects include the layer-1 (L1) blockchain network Ethereum, Cardano and the Casper blockchain.Magazine: BTC’s ‘reasonable’ $180K target, NFTs plunge in 2024, and more: Hodler’s Digest Jan 12 – 18

Bitcoin price volatility 'imminent' as speculators move 170K BTC — CryptoQuant

Bitcoin (BTC) speculators may spark “significant” BTC price volatility as a large tranche of coins moves onchain.In one of its “Quicktake” blog posts on April 18, onchain analytics platform CryptoQuant warned that a Bitcoin market shake-up is due.CryptoQuant: “Volatility is coming” for BTC priceBitcoin short-term holders (STHs) are signaling that the current calm BTC price behavior may not last long.CryptoQuant reveals that 170,000 BTC owned by entities with a purchase date between three and six months ago has begun to circulate.“Around 170,000 BTC are moving from the 3–6 month holder cohort,” contributor Mignolet confirmed. “Large movements from this group often signal that significant volatility is imminent.”BTC movements by 3-6 month hodler cohort (screenshot). Source: CryptoQuantAn accompanying chart shows the impact of previous STH events, with the latest being the largest by volume since late 2021. Price direction varies, with both upward and downward market responses visible.“Volatility is coming,” Mignolet concluded.Bitcoin speculators blamed for sell pressureAs Cointelegraph reported, STH entities are notoriously sensitive to snap market moves and transitive narratives.Related: Bitcoin gold copycat move may top $150K as BTC stays ‘impressive’Recent BTC price downside has been met with episodes of panic selling by the cohort, which is defined as an entity buying up to six months previously.Earlier this week, CryptoQuant listed STHs as one of the main sources of current Bitcoin selling pressure.“Short-Term Holders (STH) have been the primary sellers, sending an average of ~930 BTC/day to exchanges,” fellow contributor Crazzyblockk wrote in a separate Quicktake post. “In contrast, Long-Term Holders (LTH) only moved about ~529 BTC/day — highlighting short-term fear or profit-taking, while long-term conviction remains intact.”Bitcoin investor flow comparison (screenshot). Source: CryptoQuantCrazzyblockk described a “classic shakeout” occurring in Bitcoin, while allaying concerns over a uniform rush for the exit across the investor spectrum.“With Bitcoin trading sideways and volatility compressing, this cohort-driven breakdown helps us understand that the current correction is not a mass exodus by smart money — it’s more likely a reaction from nervous short-term and mid-tier holders,” the post said.This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Hashkey takes aim at XRP ETF in Asia with new fund backed by Ripple

Hong Kong-based crypto investment firm HashKey Capital announced the launch of an XRP fund, with plans to convert it into an exchange-traded fund (ETF) in the future.According to an April 18 announcement, the fund, officially titled the HashKey XRP Tracker Fund, is reportedly “the first investment fund in Asia designed to track the performance of XRP.”XRP developer Ripple will serve as the fund’s anchor investor. In a separate X post, HashKey Capital said the fund aims to bring “more institutional capital into regulated XRP products and the broader digital asset ecosystem.”Close collaboration with RippleIn another X post, HashKey Capital said the fund marks the beginning of a closer collaboration with Ripple. The two firms “are exploring new investment products, cross-border DeFi solutions, and tokenization —including the possibility of launching a money market fund (MMF) on the XRP ledger.”Related: Ripple vs. XRP vs. XRP Ledger: What’s the difference?In the announcement, HashKey Capital partner Vivien Wong said the firm will share its connections with financial institutions, regulators and investors in Asia with Ripple, adding: “Ripple offers us the opportunity to collaborate on more investment products and solutions across cross-border payment solutions, decentralized finance (DeFi), and enterprise blockchain adoption.”A Hong Kong XRP ETF in the works?The XRP (XRP) Tracker Fund is HashKey Capital’s third tracker fund and follows the firm’s Bitcoin (BTC) and Ether (ETH) ETF products. The company noted that this product may also become an ETF in the future.Source: HashKey CapitalRelated: XRP: Why it’s outperforming altcoins — and what comes nextA boon for XRP’s institutional adoption in AsiaHank Huang, CEO of Kronos Research, a crypto investment firm based in Asia, told Cointelegraph that “the launch of the XRP Tracker Fund by HashKey Capital marks a pivotal moment for institutional adoption” in the region. He said regulated and transparent products like Hashkey’s fund are what institutional investors need to enter the market. “XRP’s proven use case in cross-border payments, combined with HashKey’s robust infrastructure, sets the stage for meaningful capital inflows and wider acceptance of crypto assets in global finance,“ Huang said.Magazine: XRP win leaves Ripple and industry with no crypto legal precedent set

KiloEX exchange exploiter returns $5.5M days after $7.5M hack

The hacker behind the $7.5 million KiloEx exploit returned $5.5 million worth of cryptocurrency just four days after the attack occurred.Decentralized exchange (DEX) KiloEx suspended platform operations after suffering a $7.5 million exploit, Cointelegraph reported on April 15.In a surprising turn of events, the wallet address behind the exploit has returned $5.5 million worth of cryptocurrency to the DEX. KiloEX exploiter returns $5.5m. Source: PeckShieldAlert“#KiloEx exploiter -labeled addresses have returned ~$5.5M worth of cryptos to #KiloEx,” according to an April 18 X post from blockchain security platform PeckShieldAlert.Related: Mantra OM token crash exposes ‘critical’ liquidity issues in cryptoThe unexpected repayment occurred after KiloEx offered a $750,000 “white hat” bounty to the hacker — 10% of the stolen amount — if the hacker returned 90% of the looted assets.The platform said it was working with law enforcement and cybersecurity firms, including Seal-911, SlowMist and Sherlock, to uncover more about the hacker’s activity and identity.The initial attack may have been caused due to a “price oracle issue,” where the information used by a smart contract to determine the price of an asset is manipulated or inaccurate, leading to the exploit, PeckShield said in an April 14 X post.Related: Top 100 DeFi Hacks: Offchain attack vectors account for 57% of lossesThis is a developing story, and further information will be added as it becomes available.